Politician: Some cities have reversed the decay of aging urban areas by providing tax incentives and zoning variances that encourage renovation and revitalization in selected areas. ███ ████ ███████████ ██████ ███ ██ ██████████ ███ █████████ █████████████ ████ ██████ ███ ██ ██ ██████████ █████████████ ███ █████ ██████ ███ ████ ██ █████████ █████████████ ██████████ ███ █████████ █████████ █████ ████████ ████ ████████ ██ ████ ███ ████ ████████████ ███ ██ █████████ ████ ███ ██████

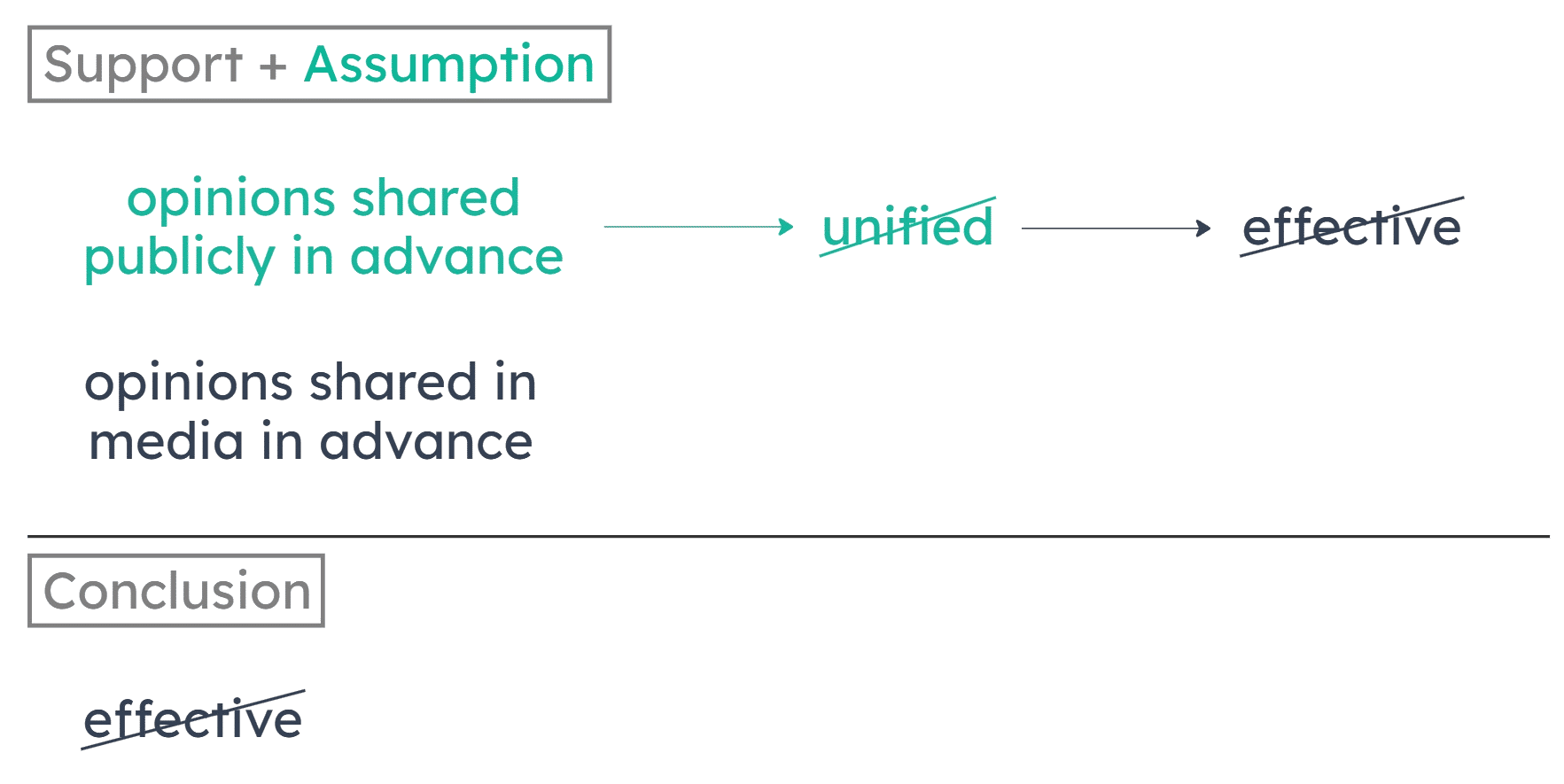

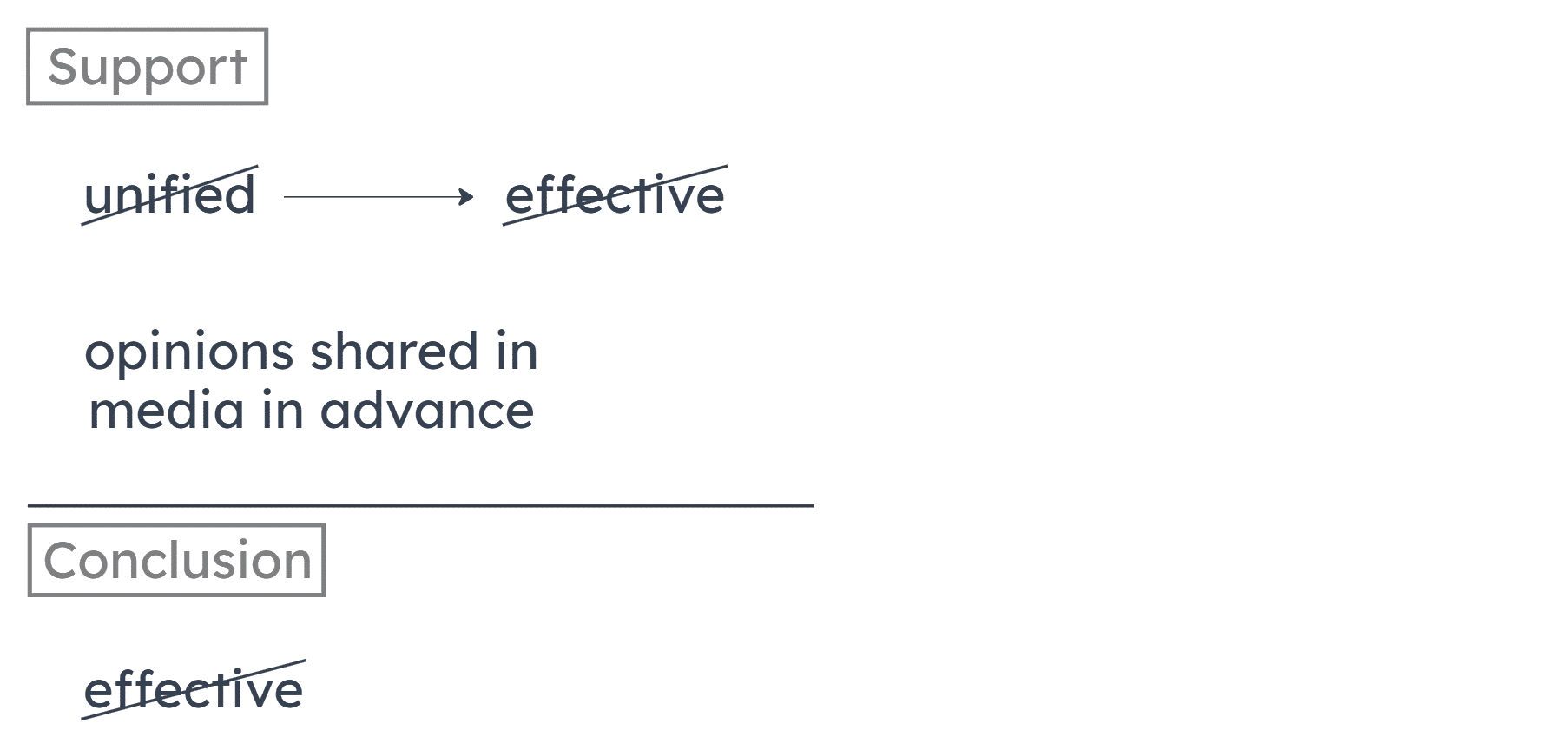

The author concludes that legislation giving tax incentives and zoning variances related to renovation in selected areas is not good.

Why?

Because the main people who benefit from the legislation are professionals who can afford the cost of renovating buildings.

But the long-term residents of the area, whom the legislation is intended to benefit, are harmed by increased rent and taxes in the area, which could force them to leave.

The author assumes that if the main people who benefit from a legislation are not the people who the legislation is intended to benefit, then the legislation shouldn’t be considered good.

Which one of the following ███████████ ██ ██████ ████ █████ ██ ███████ ███ ████████████ ██████████

Evaluation of legislation ██████ ████ ████ ███████ ██████ ████████ ███ ██████████ ██████

The wealthier members ██ █ █████████ ██████ ███ ████ █████ █████████ ██ ███ ███████████

A community's tax ████ ███ ██████ ███████████ ██████ █████ ███████ ██ ███ ███████████ ██████ ████████ ██████

Legislation that is ███ ██ ████████ ███████ ██████ ███ ██ ██████████

Laws that give █████████ ██ ███ ██████████ ███ ████ ███████ ███████ ██ █ ██████